Why Fiscal Responsibility Strengthens Nations

In an increasingly interconnected and competitive world, the financial health of a nation is paramount. A country’s ability to thrive, provide for its citizens, and maintain its standing on the global stage hinges significantly on its approach to finances. But what exactly does it mean for a nation to be fiscally responsible, and why is it so crucial for its long-term prosperity? Simply put, fiscal responsibility is about managing a nation’s finances prudently, ensuring that spending is aligned with revenue, debt is kept at manageable levels, and resources are allocated effectively to support sustainable economic growth and societal well-being.

Key Takeaways:

- Fiscal responsibility fosters economic stability by promoting balanced budgets and reducing national debt.

- Strategic investments in education, infrastructure, and healthcare, driven by sound financial planning, lead to long-term growth and a higher standard of living.

- Reduced debt burden allows a nation to better respond to economic downturns and invest in future opportunities.

- Transparent and accountable financial practices build trust and encourage investment, both domestically and internationally.

Why Fiscal Responsibility Fuels Economic Growth

A nation operating with fiscal responsibility fosters a stable and predictable economic environment. When government spending is carefully managed and aligned with revenues, it creates confidence among businesses and investors. This confidence translates into increased investment, job creation, and overall economic growth. Think of it like a household budget: if you consistently spend more than you earn, you accumulate debt and eventually face financial difficulties. The same principle applies to nations. A country burdened by excessive debt struggles to invest in essential areas such as infrastructure, education, and research and development.

Instead, a nation committed to fiscal responsibility can allocate resources strategically. These strategic investments act as catalysts for economic expansion. For example, investing in education creates a more skilled workforce, which, in turn, attracts businesses and drives innovation. Similarly, investing in infrastructure, such as roads, bridges, and transportation networks, improves efficiency and reduces the cost of doing business. These investments create a virtuous cycle of economic growth, leading to higher incomes, increased tax revenues, and further opportunities for investment. Countries like Singapore and, to some extent, the gb, have demonstrated the benefits of long-term planning and disciplined fiscal policies in achieving sustained economic success.

The Link Between Fiscal Responsibility and Reduced National Debt

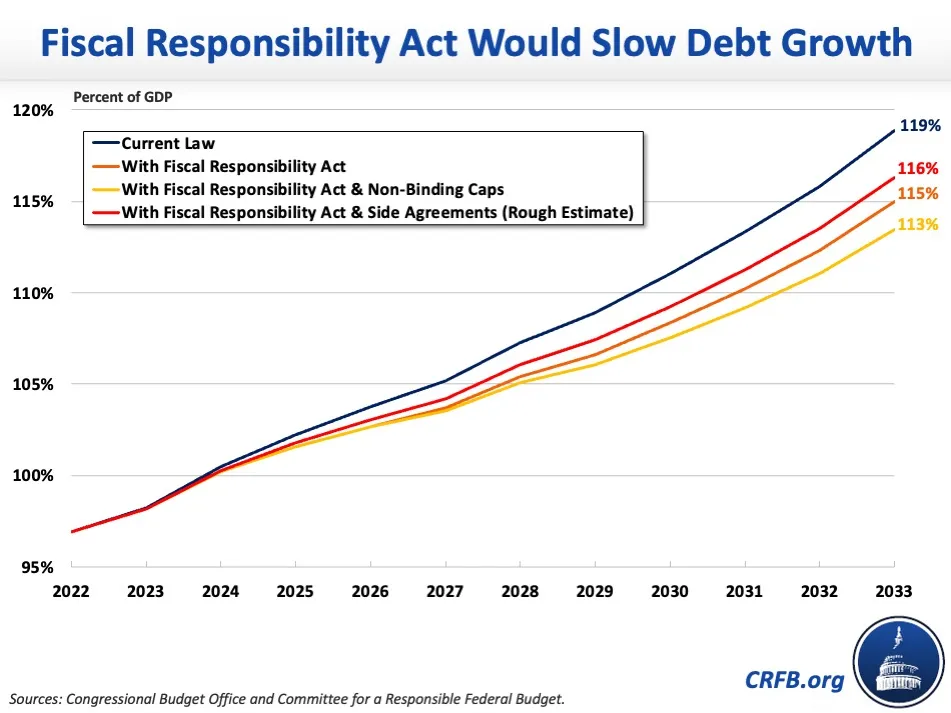

One of the most significant benefits of fiscal responsibility is the reduction of national debt. When a nation consistently spends more than it earns, it accumulates debt. High levels of national debt can have serious consequences. Firstly, it increases the amount of money a nation must spend on debt servicing, diverting funds from other important areas like healthcare, education, and infrastructure. Secondly, high debt levels can increase borrowing costs, making it more expensive for the government to finance its operations. Finally, excessive debt can erode investor confidence, leading to a decline in investment and economic growth.

By practicing fiscal responsibility, a nation can gradually reduce its national debt. This can be achieved through a combination of measures, including spending cuts, tax increases, and economic growth. Reducing national debt frees up resources for investment in other areas, lowers borrowing costs, and boosts investor confidence. This creates a more stable and sustainable economic environment, making the nation more resilient to economic shocks. Countries with lower debt-to-GDP ratios tend to have greater economic flexibility and are better positioned to weather economic storms.

How Fiscal Responsibility Enables Strategic Investment

Fiscal responsibility is not simply about cutting spending; it’s about making smart choices about how to allocate resources. A nation committed to fiscal responsibility prioritizes investments that will generate long-term economic benefits. These investments typically fall into several key areas.

Firstly, investment in education is essential for creating a skilled and adaptable workforce. A well-educated population is more productive, innovative, and entrepreneurial, which leads to higher economic growth. Secondly, investment in infrastructure is crucial for supporting economic activity. Efficient transportation networks, reliable energy supplies, and modern communication systems are all essential for businesses to thrive. Thirdly, investment in healthcare is important for ensuring a healthy and productive workforce. A healthy population is less likely to miss work due to illness and is more likely to be able to contribute to the economy. Finally, investment in research and development is vital for driving innovation and technological progress. New technologies can lead to increased productivity, new products and services, and new industries.

By strategically investing in these key areas, a nation can create a foundation for long-term economic growth and prosperity. This requires careful planning, disciplined spending, and a commitment to measuring the return on investment.

Why Fiscal Responsibility Builds Trust and Confidence

Finally, fiscal responsibility is crucial for building trust and confidence in a nation’s economy. When a government demonstrates that it is committed to managing its finances prudently, it sends a positive signal to businesses, investors, and citizens. This trust and confidence can lead to increased investment, job creation, and economic growth.

Transparent and accountable financial practices are essential for building trust. Governments should be transparent about their spending and revenue, and they should be held accountable for their financial decisions. Independent audits and oversight mechanisms can help ensure that public funds are used effectively and efficiently. A nation that is perceived as being fiscally responsible is more likely to attract foreign investment and to maintain its credit rating. This makes it easier for the government to borrow money at favorable rates, which can further support economic growth.